Streamlining Insurance Filings with a Custom CRM

Valley Insurance Associates is the third biggest company in the U.S. specializing in simplifying the insurance filing process for agents across the United States, leveraging over 48 years of experience in processing surplus lines taxes and reports. Their mission is to alleviate the stress of managing multiple filings, allowing clients to focus on what they do best.

Background Perspective

State insurance regulations are constantly changing: with over 1,700 updates in just six months of 2023. This 8% increase from the previous year meant Valley Insurance Associates needed better tools to keep up. Their success depended not just on understanding these changes, but on having systems agile enough to implement them while serving clients effectively.

Challenges

A Web of Complex Excel Spreadsheets

Valley Insurance Associates was drowning in spreadsheets. Their system consisted of dozens of interconnected Excel files, with each document pulling data from multiple others. Employees spent hours updating these intricate spreadsheets and emailing them back and forth between team members. One wrong number or accidental deletion could break formulas across multiple files, creating a domino effect of errors. Melinda, an employee at VIA, explains: "We were juggling countless Excel sheets that were all linked together, sending updated versions constantly. The lack of real-time updates made meeting deadlines incredibly stressful."

Loss of Control and Communication Chaos

Team members were working in the dark. With submissions, payments, and filing statuses scattered across various spreadsheets and email threads, it took a lot of skill to understand where everything stands. When clients called asking about their filing status, employees had to dig through multiple Excel sheets, search through email chains, and sometimes even wait for responses from teammates who had the latest versions of files. Melinda paints the picture: "We felt like we were spending more time hunting down and cross-checking information than actually helping clients. A teammate’s sick leave or vacation also meant logistical challenges, because crucial information lived in their email inbox or personal files."

A Website Stuck in the Past

Valley Insurance Associates needed more than just a band-aid solution. With both internal operations and client satisfaction at stake, the time had come for a complete digital transformation. That's when The Digital Bunch stepped in to turn this challenge into an opportunity.

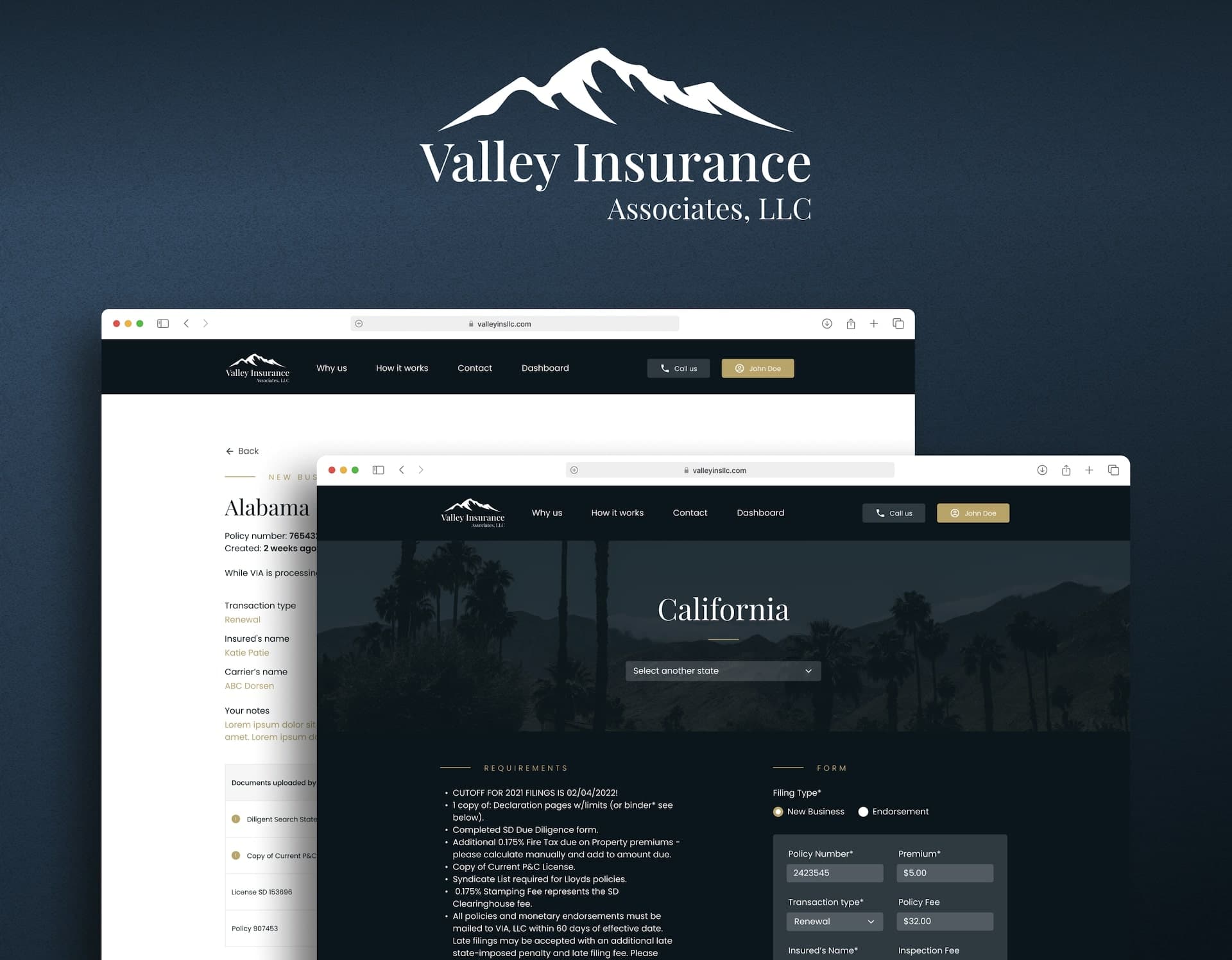

Solution: Revitalizing Valley Insurance Associates: Our Journey to Custom CRM Implementation

Our Approach

We used a Product Design Sprint to transform Valley Insurance Associates' workflow. During a two-week discovery phase, our team immersed itself in the client’s daily routines, closely shadowing employees to identify pain points and inefficiencies. We tracked tools, communication methods, and workflow patterns to identify areas that needed improvement or automation.

For instance, employees would walk us through and express frustration with compiling fragmented reports from various PDFs—a manual process fraught with delays and errors. Collaborating closely with VIA, we prioritized automating these repetitive tasks.

Throughout the discovery phase, we developed wireframes, estimated timelines and costs, and mapped the system architecture for a tailored solution. We ensured that VIA was aligned with our plans before moving into development. At the conclusion, we provided a detailed document summarizing insights, ideas, and actionable plans, with next steps organized into clear milestones for the software implementation phase.

Scope & Milestones

With established milestones from the discovery phase, we transitioned to implementation, maintaining focus on high-impact tasks that would transform VIA’s workflow.

Milestone I: Administration Panel – New Features

31 man days

- States Settings: A comprehensive list of states with filters for assigning states to employees, setting rates, and defining required documents.

- User Management: A user preview feature with filters for data editing, password resets, and visibility settings.

- Filings Management: A centralized list of filings with filters for adding new filings, assigning employees, managing documents, and sending email notifications.

- File Uploading: Streamlined file upload process for filings, automating email notifications with file names and access links.

- Dashboard: A dashboard for system statistics, including filing counts across categories.

Milestone II: Client Panel & Invoicing

27 man days

- Filing Submission Form: A user-friendly form supporting state-specific requirements, automated calculations, validations, and document uploads.

- User Registration Flow: A seamless sign-up form for new user registration.

- Browsing Previous User Filings: Allows users to view their past filings and statuses, enhancing transparency.

- Email Notifications: Handles scenarios for users clicking links in notification emails for newly uploaded documents.

Milestone III: Enhancements

3.5 man days

- Browser Notifications: Real-time notifications for administrators on new filings for timely processing.

- User Document Uploads: Enables users to upload documents anytime, with UI highlights for new uploads until marked as "Completed."

- Existing User Migration: Successfully migrated existing users to the new platform for a smooth transition.

User-Centric Website Redesign

Alongside the CRM implementation, we completely redesigned VIA's website, refreshing the logo, color palette, and typography to create a modern look. We prioritized enhancing user experience (UX) and user interface (UI), resulting in a simplified client experience that allowed for easy form submissions and centralized status tracking—significantly improving client satisfaction.

Demonstrating Measurable Results

Our custom CRM implementation delivered a game-changing productivity boost: three hours saved per employee every single day, accumulating to a staggering 4,000 hours annually. This isn't just time saved—it's time reinvested. We've effectively created an entire work quarter of productive capacity, enabling VIA's team to focus on high-impact initiatives, creative problem-solving, and driving business growth instead of getting lost in administrative tasks.

Employee Insights

“We're all super excited about the new system. We can track everything in real time, which makes managing client communications and filings so much easier. It’s not just about being more productive; it’s given us the confidence to meet deadlines without the usual stress." – Melinda, Employee at Valley Insurance Associates

Client Feedback

"The Digital Bunch has been an invaluable partner in transforming our operations. Their commitment to quality work and excellent communication made it easy to collaborate. They delivered on time, responded quickly to our needs, and truly understood our vision, resulting in an interactive app and website that meet our requirements seamlessly.” – Gina Doyle, Owner at Valley Insurance Associates

Paving the Way for Future Growth

The shift from a manually handled Excel workflow to a fully functional web application based on our CRM solution has fundamentally transformed how VIA operates. It has not only streamlined internal processes and improved client satisfaction (let's not forget about the new website!) but also ensured that VIA is well-positioned for sustained growth in the ever-evolving insurance landscape in the U.S.